Press Release: 2022-05-26

Book Reveals How Tax Hike Amendment Would Damage Commonwealth’s Economic Competitiveness

Book Reveals How Tax Hike Amendment Would Damage Commonwealth’s Economic Competitiveness:

May 25, 2022 by Editorial Staff

Punishing tax on small businesses and retirees unlikely to significantly increase transportation and education funding

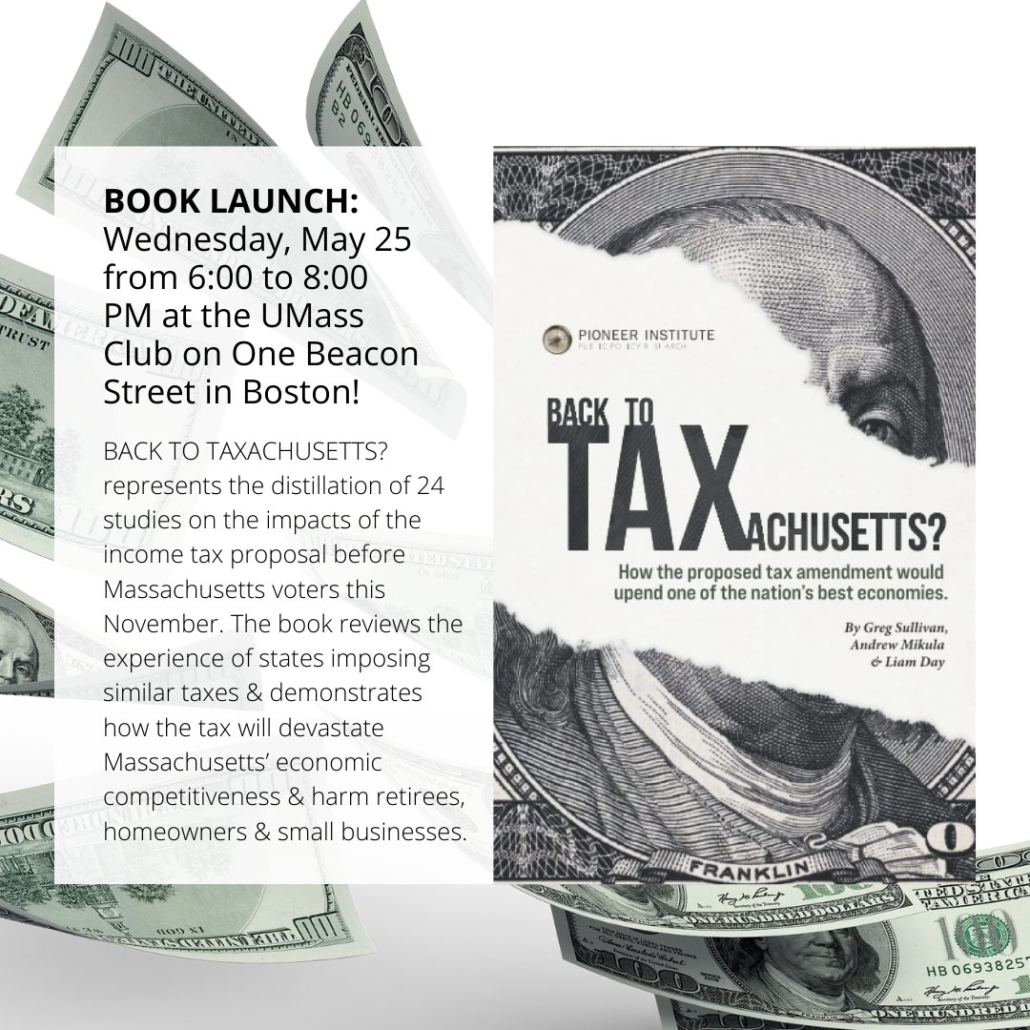

BOSTON – If adopted, a constitutional amendment to hike state taxes that will appear on the ballot in November could erase the hard-earned progress Massachusetts has achieved toward economic competitiveness over the last 25 years and may not result in any additional education and transportation funding, according to a new book from Pioneer Institute, entitled Back to Taxachusetts?: How the proposed tax amendment would upend one of the nation’s best economies, which is a distillation of two dozen academic studies.

“People — even some in the media and business community — don’t understand the tax and what it does,” said Jim Stergios, executive director of Pioneer Institute. “This book explains the many forms of income it will sweep up, the real people and businesses it will affect, and the fact that, despite misleading promotional language from the Attorney General, it will likely result in little to no increase in education and transportation funding.”

A tax on small businesses, homeowners and retirees

The amendment to the Massachusetts Constitution would have a particularly significant impact on retirees and small businesses. It would affect a long list of “income” categories, including salary, capital gains (on the sale of investments, homes, businesses and other assets), dividends, IRA and 401K distributions, interest, royalties, and commissions. In any one year, should the totality of these income streams exceed $1 million, the state would increase existing income taxes by 4 percent on the excess.

“Pass-through” companies such as partnerships, limited liability corporations, subchapter S corporations and sole proprietorships are taxed via individual returns. These mostly small businesses, nearly two thirds of which are subchapter S corporations, employed almost half of all private, for-profit employees in Massachusetts in 2019.

Passage of the constitutional amendment would force many pass-through businesses to pay the new 4 percent tax on top of the existing 5 percent income tax. Subchapter S corporations, which currently pay Massachusetts’ unique “stinger tax” of up to 3.9 percent, would face a total state tax burden of up to 12.9 percent, a rate higher than large corporations pay.

In addition, adopting the tax hike amendment would give Massachusetts the nation’s highest short-term capital gains tax (16 percent) and the highest long-term capital gains tax in New England.

“[Massachusetts’ tax proposal] would impose a one-time ‘retirement tax’ on many sellers of homes and small businesses, and encourage our most productive residents to leave,” said Richard Schmalensee, former Dean of MIT’s Sloan School of Management. “[A]ll without guaranteeing an increase in spending on transportation or education.”

The book reveals just how wide a net the tax casts well beyond “millionaires.” In fact, the tax hike amendment falls primarily on households selling a family home or business to finance retirement. Nearly half of all parties affected by the tax earn $1 million or more only once in a decade; over 60 percent do so only twice.

The tax would apply to more residents every year. To adjust for inflation, the tax amendment uses the Chained Consumer Price Index for All Urban Consumers, which has lagged well behind household income and wages in Massachusetts. State legislative salaries, on the other hand, are tied to median household income, which has risen much faster.

“Proponents call this the “Fair Share Amendment,” suggesting that it applies to some nebulous fat cat,” said Pioneer Research Director Greg Sullivan, who, with Andrew Mikula and Liam Day, authored Back to Taxachusetts? “But the fact is that the large majority of affected parties will be retirees or small businesses — families that paid down their mortgages and loans and most often never made anything close to a million.”

Fewer jobs, people and employers vote with their feet

We don’t need to look far to see the proposed tax’s likely economic impact. From 2008 to 2020, Connecticut, which is still recovering from years of “tax the rich” policies and today boasts the second highest state and local tax burden per capita (Massachusetts ranks 14th):

- Ranked 49th among the states and Washington, D.C., in private sector wage and job growth

- Had wage growth that was half the rate of wage growth in Massachusetts

- Had fewer jobs in 2020 than in 2008, while Massachusetts’ 11.8 percent job growth outpaced the nation

As Connecticut Governor Ned Lamont has said, “It’s really dumb to [raise taxes on wealth] just by the state” and doing so would “totally disadvantage the state. [Connecticut] already [has] some of the highest income tax rates in the country and we pay a price for that.”

Many large employers left the Constitution State, including GE and Alexion Pharmaceuticals, which relocated to Massachusetts. Between 2012 and 2018 Connecticut experienced the second worst net out migration of high-income taxpayers.

Among many other tax hikes, Connecticut increased its highest income tax rate from 4.5 percent to 6.99 percent between 2003 and 2018, while Massachusetts reduced its rate from 5.6 percent to 5.1 percent. Because of its lackluster economy, Connecticut could only muster 22 percent growth in the state budget from 2008 to 2020, while Massachusetts, with strong economic growth, saw its budget grow 63 percent.

“A stable tax environment, together with Massachusetts’ innovation economy, resulted in a significant rise in jobs and wages in Massachusetts,” Sullivan said. “Massachusetts’ economic growth field budget growth at three times the rate in Connecticut — generating revenue that public sector leaders could invest in public priorities like education and transportation.”

If the tax hike amendment passes, Massachusetts will have a higher top-end rate than Connecticut.